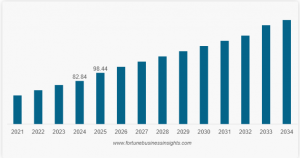

Micro-Mobility Market to Reach USD 368.20 Billion by 2034 from USD 197.50 Billion in 2025, Growing at 7.0% CAGR

Global micro-mobility market to grow from USD 213.70 billion in 2026 to USD 368.20 billion by 2034, driven by urbanization and shared mobility.

PUNE, MAHARASHTRA, INDIA, February 8, 2026 /EINPresswire.com/ -- The Micro-Mobility Market was valued at USD 197.50 billion in 2025 and is projected to grow from USD 213.70 billion in 2026 to USD 368.20 billion by 2034, registering a CAGR of 7.0% during 2026–2034.Micro-mobility includes electric scooters, e-bikes, bicycles, and light electric mopeds designed to support last-mile connectivity, urban commuting, and short-range travel. These vehicles are increasingly integrated into both shared mobility platforms and personal ownership models. The ecosystem also covers battery systems, charging infrastructure, fleet management software, and mobility-as-a-service (MaaS) platforms.

Market Overview

Urban congestion, rising fuel costs, and increasing environmental awareness are major factors accelerating adoption. Governments across developed and emerging economies are promoting low-emission transport solutions through subsidies, infrastructure investments, and regulatory support. The integration of IoT-based fleet tracking, digital payments, and real-time vehicle monitoring is improving operational efficiency and user experience.

As urban populations continue to expand and cities focus on sustainability, micro-mobility is becoming a core component of modern urban transport systems, offering affordable, flexible, and eco-friendly alternatives to traditional vehicles.

Request a sample PDF:-

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/micro-mobility-market-115031

Market Segmentation

By propulsion type, the market is divided into electric and manual/human-powered vehicles. The electric segment accounts for a significant share due to the rising popularity of e-scooters and e-bikes. Improvements in lithium-ion battery technology, longer battery life, faster charging, and declining battery costs are making electric micro-mobility vehicles more accessible and affordable for consumers.

By vehicle type, the market includes e-scooters, e-bikes, bicycles, and light electric mopeds. The bicycles segment holds the largest market share, driven by widespread consumer acceptance, affordability, and strong integration into public bike-sharing programs. E-bikes are also witnessing rapid growth, particularly among commuters seeking longer travel ranges with less physical effort.

By speed category, the market is classified into low-speed, mid-speed, and ultra-low-speed vehicles. The mid-speed segment dominates the market as it provides an optimal balance between speed, safety, and regulatory compliance. These vehicles are well-suited for urban commuting and are widely accepted by city regulators.

By end-user, the market is segmented into individual consumers and enterprises. Individual consumers dominate due to the growing trend of personal ownership of e-bikes and e-scooters for daily commuting, fitness, and leisure. Enterprise users, including shared mobility operators and corporate fleets, also represent a significant segment, particularly in densely populated urban areas.

Request a sample PDF:-

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/micro-mobility-market-115031

Key Players

Major companies operating in the global micro-mobility market include:

Lime (U.S.)

Bird Global (U.S.)

Dott (Germany)

Spin (U.S.)

Segway-Ninebot (China)

Yadea Technology Group (China)

Giant Manufacturing Co., Ltd. (Taiwan)

Xiaomi (China)

Gogoro Inc. (Taiwan)

VanMoof (Netherlands)

These players focus on expanding fleet sizes, improving battery performance, integrating IoT and GPS technologies, and forming partnerships with municipalities to strengthen their market presence.

Report Coverage

The Fortune Business Insights report provides comprehensive analysis of market size and forecast across all segments. It includes detailed evaluation of market drivers, restraints, opportunities, and trends. The report also covers technological advancements, new product launches, partnerships, mergers and acquisitions, and competitive landscape analysis. The study covers historical data as well as future projections, offering insights into technological advancements, product innovations, and changes in regulatory frameworks. It also includes a competitive landscape analysis, highlighting key strategies adopted by major players, including mergers and acquisitions, partnerships, and new product launches.

The study period spans 2021–2034, with 2025 as the base year and forecasts provided for 2026–2034. The report delivers both qualitative and quantitative insights to help stakeholders make informed strategic decisions.

Speack To Analyst:-

https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/micro-mobility-market-115031

Drivers and Restraints

Drivers

One of the primary drivers is the rapid expansion of shared mobility ecosystems. Cities are integrating e-scooters and e-bikes into urban transport networks to improve last-mile connectivity. Growth in MaaS platforms that combine public transit with micro-mobility options is also enhancing accessibility and convenience.

Government initiatives promoting low-carbon transportation, along with investments in cycling lanes and charging infrastructure, are further supporting market growth. Rising urban congestion and consumer demand for affordable, flexible commuting solutions continue to boost adoption.

Restraints

Regulatory restrictions and permitting limits are key restraints. Many cities impose strict rules on fleet size, parking, and operational zones, which can limit scalability for operators. Safety concerns, including accident risks and inconsistent helmet usage, also lead to tighter regulations and can reduce consumer confidence.

Safety concerns also remain a significant issue. Accidents involving e-scooters and bicycles have raised concerns among regulators and the public, leading to stricter safety rules and helmet requirements in some regions. Infrastructure limitations, such as insufficient cycling lanes and poor road conditions, can further hinder adoption in certain markets.

Regional Insights

Asia Pacific dominates the global micro-mobility market, supported by rapid urbanization, high population density, and strong government backing for electric mobility. Countries such as China, India, Japan, and South Korea are key contributors, with large-scale bicycle sharing programs and expanding e-scooter adoption.

North America shows strong growth due to widespread deployment of shared e-scooter platforms and investments in cycling infrastructure across major cities. Europe is a mature market driven by strict environmental regulations, advanced cycling networks, and high adoption of e-bikes for daily commuting.

The Rest of the World, including Latin America and the Middle East & Africa, represents emerging growth opportunities as urban infrastructure and awareness of affordable mobility solutions improve.

Key Industry Developments

April 2025: Voi Technology partnered with Wible in Spain to integrate e-scooters into a multimodal mobility app.

April 2024: Tern launched Bosch-powered e-bikes in Taiwan.

March 2024: Merida introduced new Shimano-powered electric bike models.

November 2023: Giant Group launched its first throttle-enabled electric bike under its Momentum brand.

Related Reports:-

Bicycle Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.